Selling on Amazon Canada: The Complete Guide

Table of Contents

- Introduction

- Can Amazon FBA Be Done in Canada?

- Can You Sell on Amazon.ca if You Live in a Different Country?

- What Are the Benefits of Selling on Amazon.ca vs Amazon.com?

- Do You Need a Canadian Business License to Sell on Amazon.ca?

- What Documents Are Required to Apply for Amazon.ca?

- Do Amazon Sellers Have to Pay Canadian Taxes?

- What Is the Average Income for Amazon Sellers in Canada?

- Is Amazon FBA Worth It in Canada?

- How Do I Sign Up for Amazon.ca?

- Are Customer Behaviors Different in Canada vs the United States?

- Which Products Perform Well on Amazon.ca?

- How Do I Launch a Product on Amazon.ca?

- How Do I Add My Existing Amazon.com Listings to Amazon.ca?

- Tips for Selling on Amazon Canada

- Account For Higher FBA Fees

- Understand the Tax Rules

- Monitor the Exchange Rate

- Consider Using Remote Fulfillment

- Enroll in Brand Registry on Amazon.ca

- Conclusion

Introduction

The Amazon US marketplace is significantly larger than the Canadian marketplace in terms of product offerings as well as seller count. This makes Amazon US way more competitive than Amazon Canada.

The good news for those who want a piece of the pie in the Canadian marketplace is that Amazon holds a prominent position within Canada’s e-commerce landscape. Based on insights from 2023, it is indicated that Amazon is poised to secure approximately 40% of the total retail e-commerce sales market in Canada. There is lots of growth opportunity in this market as we will learn later in this blog.

Outclass Your Competitors

Achieve More Results in Less Time

Maximize your results and drive success faster with Helium 10’s full suite of Amazon and Walmart solutions.

Sign Up for FreeCan Amazon FBA Be Done in Canada?

Amazon FBA (Fulfillment by Amazon) can indeed be done in Canada. Amazon offers its FBA program to sellers in Canada, providing a comprehensive solution for warehousing, packing, and shipping your products to customers across the country and beyond. This service enables FBA sellers to tap into Amazon’s vast customer base and benefit from their world-class logistics network. It’s a powerful way to streamline your operations and scale your business efficiently, making it a viable option for those looking to sell on Amazon in Canada.

Can You Sell on Amazon.ca if You Live in a Different Country?

Yes, international sellers can absolutely sell on Amazon.ca. Amazon provides a global platform for sellers, allowing individuals residing in different locations to tap into the Canadian market. To initiate this process, you’ll need to create a dedicated seller account for Amazon.ca, distinct from your primary Amazon seller account associated with your home country.

You have the option to fulfill orders yourself by shipping products directly to Canadian customers, or you can leverage Amazon’s Fulfillment by Amazon (FBA) service. With FBA, your inventory is stored in Amazon’s Canadian fulfillment centers, and they handle packing and shipping, offering Prime members free, two-day shipping. With the right strategy and understanding of the Canadian market, selling on Amazon.ca from a different country can open up valuable opportunities for expanding your e-commerce business.

Another aspect to consider is if you are selling on Amazon US, then you can take advantage of NARF (North America Remote Fulfillment) or Remote Fulfillment with FBA to sell to customers in Canada, Mexico and Brazil without having to send inventory to those countries. The Remote Fulfillment with FBA program uses your inventory in the US fulfillment center to fulfill order across the borders and ship inventory to customers on Amazon.ca, Amazon.com.mx, and Amazon.com.br.

The program helps you learn how to sell on Amazon without inventory and provides Prime customers with complimentary shipping to Canadian customers, however, the buyers are responsible for any applicable import duties and taxes for the items they purchase. Shipping to Canada takes anywhere from 7 to 12 days.

What Are the Benefits of Selling on Amazon.ca vs Amazon.com?

Selling on Amazon.ca offers several distinct benefits, particularly for amazon.com sellers looking to expand globally with the lowest possible risk. One of the primary advantages is reduced competition. While Amazon.com is a massive marketplace with intense competition, Amazon.ca is less saturated, providing sellers with a chance to stand out more easily.

The PPC costs on the Canadian marketplace are way lower than the US marketplace, allowing you to increase your profit margins. With less competition, there’s also comparatively less price wars. This once again gives you the opportunity to increase your profit margins.

Moreover, by selling on Amazon.ca, you can diversify your income streams and reduce risks associated with relying solely on one marketplace. Expanding internationally, especially to neighboring countries like Canada, can be a strategic move for your e-commerce business, contributing to its growth.

With your current product line on amazon.com, you can test the waters through the North America Unified Account. What the North America Unified Account does is puts all your listings across Canada, US and Mexico, under one dashboard. This way you can see which products are a good fit for selling on amazon Canada without committing to the entire process of setting up an account and figuring out logistics from scratch. You can leverage the same product and their listing pages onto amazon.ca along with a review transfer.

Do You Need a Canadian Business License to Sell on Amazon.ca?

No, you do not need a Canadian business license to sell on Amazon.ca. It is entirely optional to have a registered Canadian business. Your Amazon FBA business can be registered as a limited liability company, which will allow you to qualify for brand registry and other advanced seller tools. However, it is also possible to just run you FBA business as a sole proprietorship.

While a Canadian business license is not required, you may need to register for the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST) if your sales exceed certain thresholds. In order to get GST/HST registered, you will need a business number.

What Documents Are Required to Apply for Amazon.ca?

In order to set up your Seller central account you will need the following:

1. Email address: used for logging into your seller central

2. Internationally chargeable credit card: like VISA, Mastercard, or AMEX for any payments

3. Copy of your passport or IDs: for verification purposes

4. Tax information: like your GST or HST registration number to sort out tax collection, and remittance

5: Valid phone number: for verification purposes

6. Bank account number: for receiving payments from Amazon sales

That is all you need in order to start selling on Amazon Canada. However, if you want to scale your business and take advantage of Amazon FBA then you would need a GST/HST number as well.

For an in-depth look into the selling tool, check out our Amazon Seller Central guide that covers everything you need to know.

Do Amazon Sellers Have to Pay Canadian Taxes?

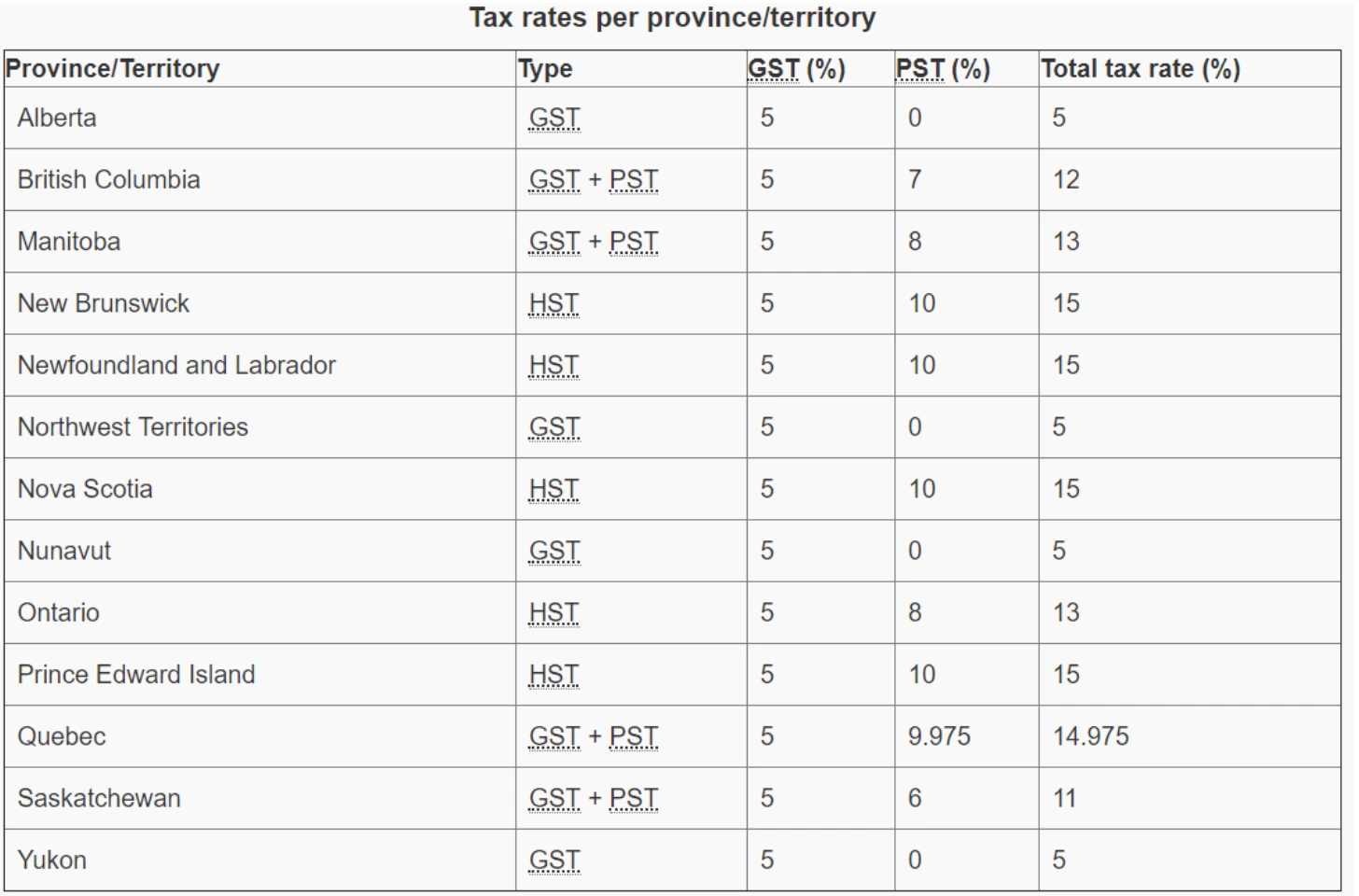

Yes, Amazon sellers are generally required to pay sales tax when selling on Amazon.ca. Therefore, it is also essential to acquaint yourself with Canadian tax regulations and legal requirements. Canada has three different types of taxes: the Goods and Services Tax (GST), the Harmonized Sales Tax (HST), and the Provincial Sales Tax (PST) on most goods and services, depending on the destination your customer resides in.

GST is a federal sales tax and its 5% Canada-wide. Some provinces only impose the Goods and Services Tax and so the tax rate will be 5% flat. The Provincial Sales Tax (PST) is a province specific sales tax and each province has their unique way of handling and filing this sales tax. Provinces that charge the PST are British Columbia, Manitoba, Saskatchewan, and Quebec. The Harmonized Sales Tax (HST) is a combination of the Goods and Services Tax (GST) and the Provincial Sales Taxes (PST). Provinces that charge an HST on sales are Ontario, Nova Scotia, New Brunswick, Prince Edward Island, Newfoundland and Labrador. Sales tax can range from 5%, which is the GST alone, all the way up to 15%, which includes the 5% GST and 10% PST. Here is a breakdown of the tax rates in each province.

As an international Amazon seller, you may need to register for these sales taxes, collect them from your customers, and remit them to the Canadian government if your sales meet certain thresholds. You will be provided a simplified GST/HST registration and remittance framework to follow as a non-resident seller. If you have not yet registered for GST/HST and are not required to, then Amazon will be responsible for calculating, collecting and remitting HST on your sales.

If you exceed or plan on exceeding $30,000 CAD over a 12-month period, you are obligated to register for the collection and remittance of GST/HST. Canada Revenue Agency (CRA) will be a good resource to consult to make sure your Amazon business is complying with all the tax obligations.

The specific tax obligations can vary depending on factors like your sales volume, where your business is located, and which province your customer resides in. It’s crucial to understand and comply with these tax requirements to avoid any legal issues. Many sellers seek guidance from tax professionals like Canadian Chartered Professional Accountants (CPAs) or use tax compliance tools to ensure they meet their Canadian tax obligations while selling on Amazon.ca.

Manage Everything With Next-Level Software

Sign up now to access powerful, easy-to-use tools to help with every part of selling on Amazon and Walmart.

What Is the Average Income for Amazon Sellers in Canada?

Based on a survey in 2021, 54.5% of Canadian Amazon sellers were making over $50,000 per year. The exact figure will vary depending on how well you’re ranking on the Canadian platform, what pricing strategy you’re employing, your conversion rates, your PPC spend, the category you’re selling in and so much more.

The best way to get an estimate for a range of your earning potential is to note down your price on the US marketplace, your review count, your review ratings, and the number of variations. Then go on Amazon.ca, find competitors that have similar traits based on the 4 factors aforementioned and analyze where you may fall within that market. The competitors with similar traits may all have different sales revenue figures, but with this activity you will be able to get a range for what your earning potential may look like on the Canadian marketplace. Let’s go over an example to better understand the process.

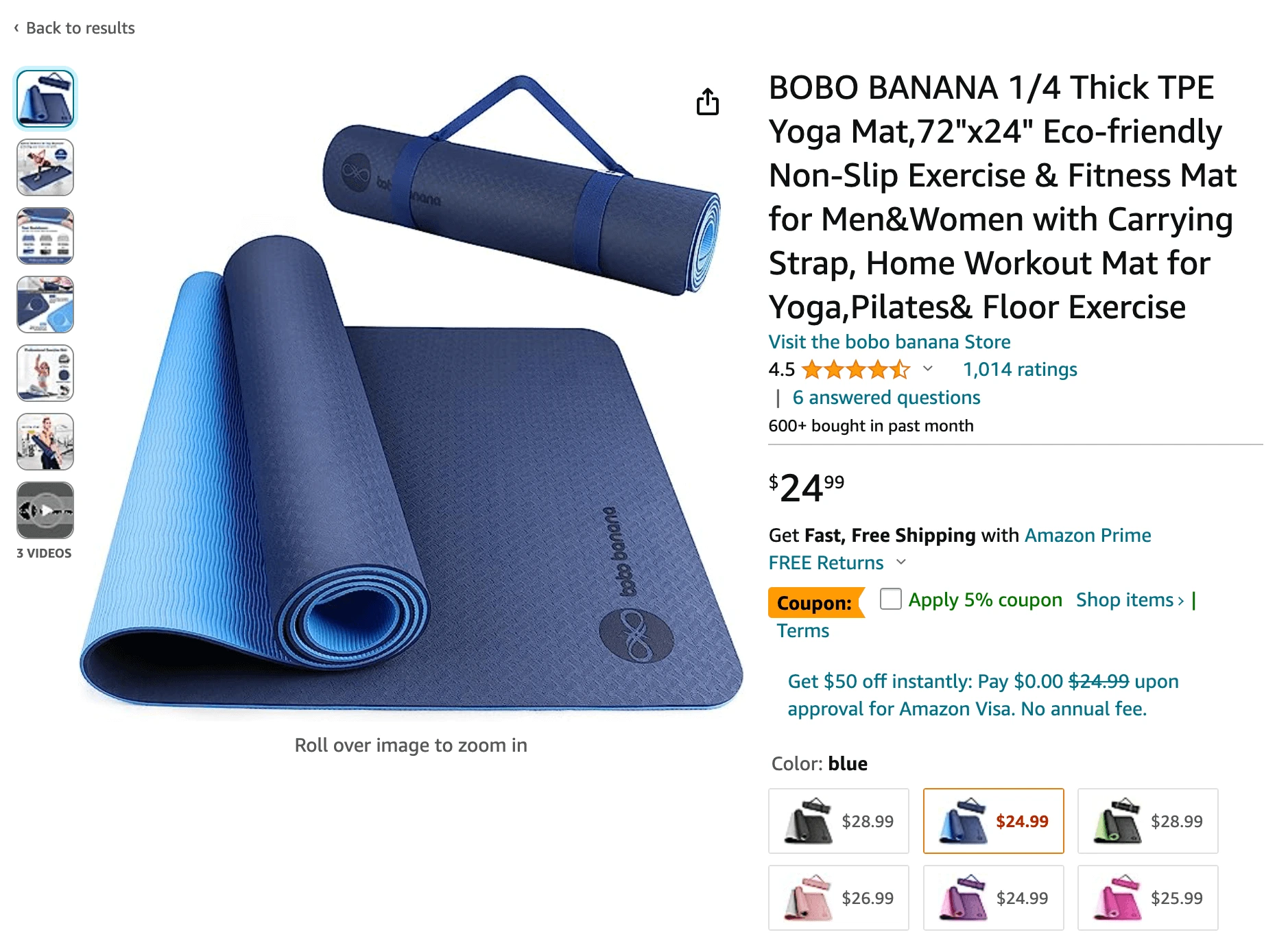

Let’s say you are selling a ‘non-slip yoga mat with a strap’ on amazon US. Here is the data for these 4 factors:

– Price on the US marketplace: $25

– Review count: 1014

– Review rating: 4.5

– Number of variations: 6

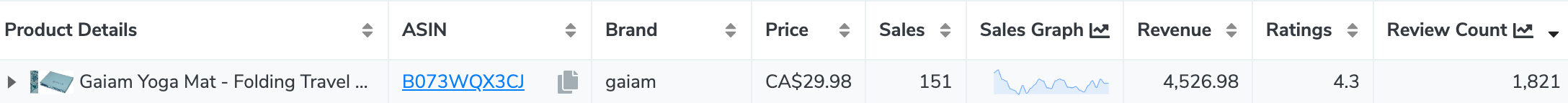

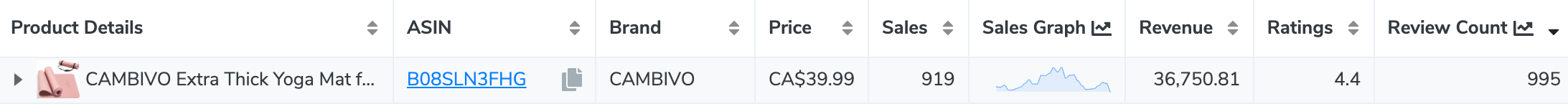

Search yoga mat on amzon.ca and run Helium 10’s Xray Chrome Extension on it. Sort the pricing from highest to lowest. Since this product is $25 in the US it will be roughly $34 when converted to Canadian dollar (calculated at the time of writing). You can also do another round of search by sorting through review count. Keep in mind, it will be impossible to find a competitor with the exact same price, review count, review rating, and variations, so you will have to look for ones that are in a close range of numbers to yours. Here are some competitors I found for Bobo Banana’s yoga mats.

Gaiam is quite close in traits to our product, it has the following traits:

Price: $29.98

Review count: 1821

Review rating: 4.3

Number of variations: 5

Cambivo is another competitor who is quite close in traits to our product, it has the following traits:

Price: $39.99

Review count: 995

Review rating: 4.4

Number of variations: 4

Based on the insights from my competitor research, you could make between 151 to 919 sales. So if we multiply our Canadian price ($34) by the sales we will get a range for our sales revenue. Since Sales Revenue = Number of Sales x Price per item, your revenue range in Canadian dollars would come out to $5,100 to $31,000 per month.

Is Amazon FBA Worth It in Canada?

Yes, taking an Amazon FBA course in Canada can be incredibly worthwhile for many aspiring and established e-commerce entrepreneurs as it offers a range of benefits that make it a compelling choice.

In 2021, Amazon Canada had net sales of 13.216 million CAD, this only forecasted to grow. First and foremost, you gain access to Amazon’s vast customer base which provides access to a massive audience that would be challenging to reach through other means. The platform gives your product the visibility and sales potential. Additionally, FBA takes care of the often complex and time-consuming logistics of warehousing, packing, and shipping. This not only saves you valuable time but also ensures efficient and reliable delivery, enhancing the customer experience.

Furthermore, Amazon’s trusted brand and reputation can instill confidence in potential buyers, potentially leading to higher conversion rates. However, it’s essential to weigh these advantages against the associated costs and fees to determine if the product you have chosen can give you results that you are looking for. Many sellers find that the convenience and reach of Amazon FBA make it a valuable investment, but it’s crucial to conduct thorough product research and consider your specific requirements before diving in.

How Do I Sign Up for Amazon.ca?

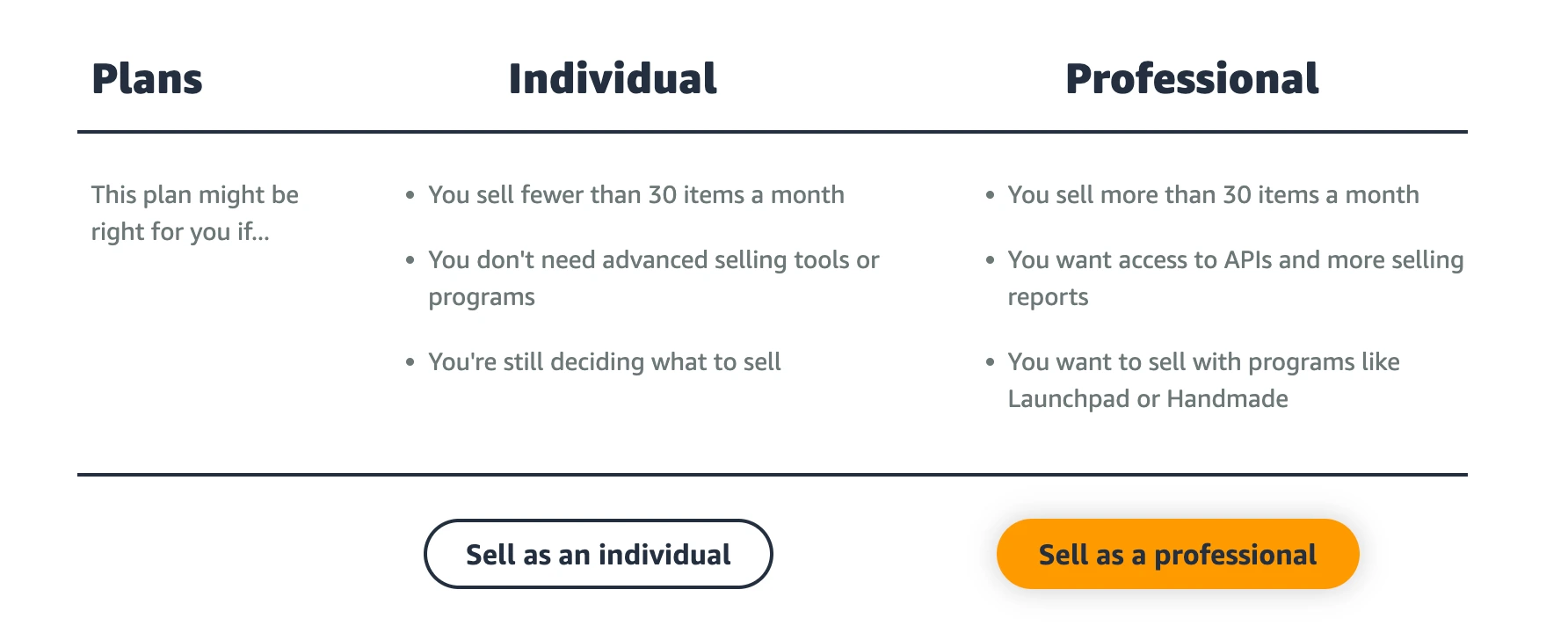

Before you begin your registration process, decide which selling plan is suitable for you. Individual plan sellers are charged CDN $1.49 for each sale, whereas Professional plan sellers pay a fixed monthly fee of CDN $29.99, regardless of the number of items sold. If you anticipate selling more than 30 items per month, opting for the Professional selling plan is a cost-effective choice. Rest assured, you have the flexibility to switch between plans whenever you wish.

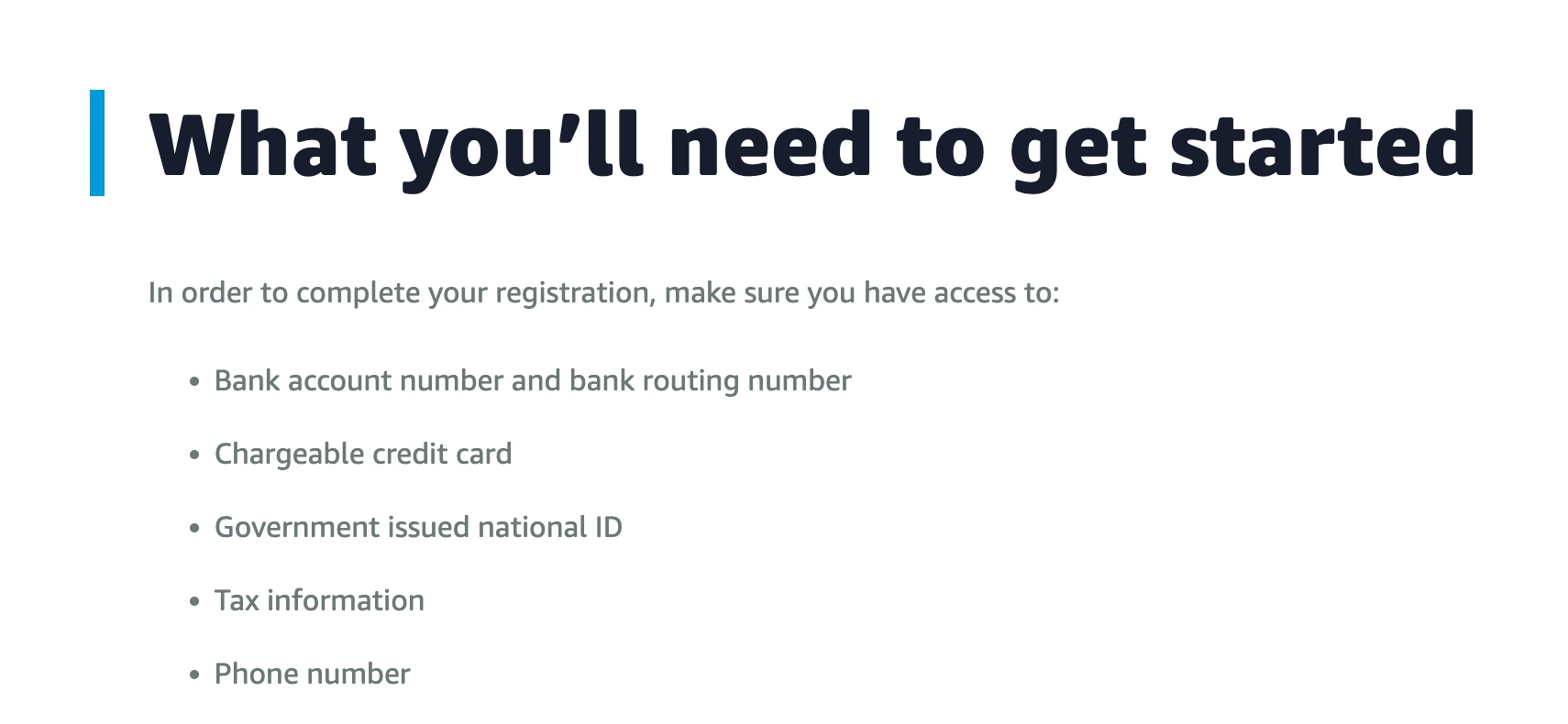

Many sellers opt for the professional selling plan in order to take advantage of Amazon’s advanced selling tools. Once you’ve chosen your ideal plan type, make sure you have the following information handy so that your registration process can go smoothly:

– Bank account and bank routing number

– Credit card information

– Government issued national ID

– Tax information

– Phone number

Begin your registration process by going to Amazon.ca and hitting the ‘sign up’ button. This will take you through a series of steps that will require your business information, seller information, billing details, store details and finally verification to conclude the process. Once you have completed all these steps you should have access to your account on seller central Canada.

Are Customer Behaviors Different in Canada vs the United States?

Yes, customer behaviors in Canada can differ from those in the United States, and understanding these distinctions is crucial for successful selling on Amazon.ca. Firstly, while Canadians are generally comfortable with online shopping, they may exhibit slightly different preferences or may search for products with different keywords. For instance, they might have a preference for metric measurements, French and English language options, a strong inclination towards locally sourced or Canadian-made products, and using different terminology, like calling a beanie a toque.

Moreover, Canadian consumers may be more attuned to seasonal and weather-related trends due to the country’s diverse climate. This means that product demand can vary significantly based on the time of year and regional weather conditions. Additionally, considerations related to shipping costs and delivery times are of paramount importance to Canadian customers, given the country’s vast geography. Sellers targeting the Canadian market should be prepared to address these unique consumer behaviors and preferences to effectively cater to their audience.

However, at the end of the day it is still the same platform, that is Amazon, and it employs the same algorithm. So the rules of the game will be the same for all aspects of amazon selling, whether its keyword research, ppc or listing optimization. The only thing that will differ would be the actual outcome, for example, after conducting your research you might end up with different listing images on the Canadian marketplace as opposed to the US.

Which Products Perform Well on Amazon.ca?

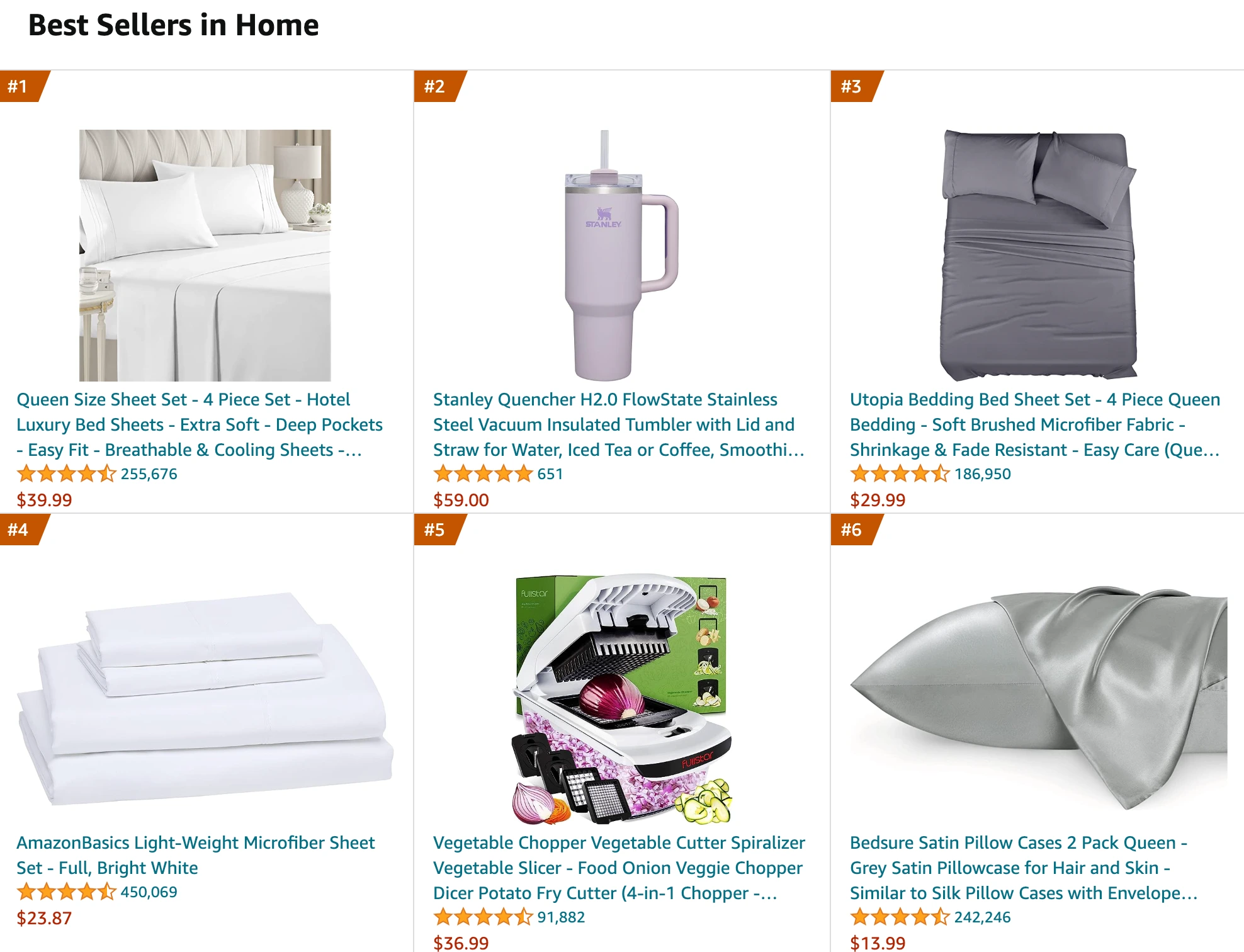

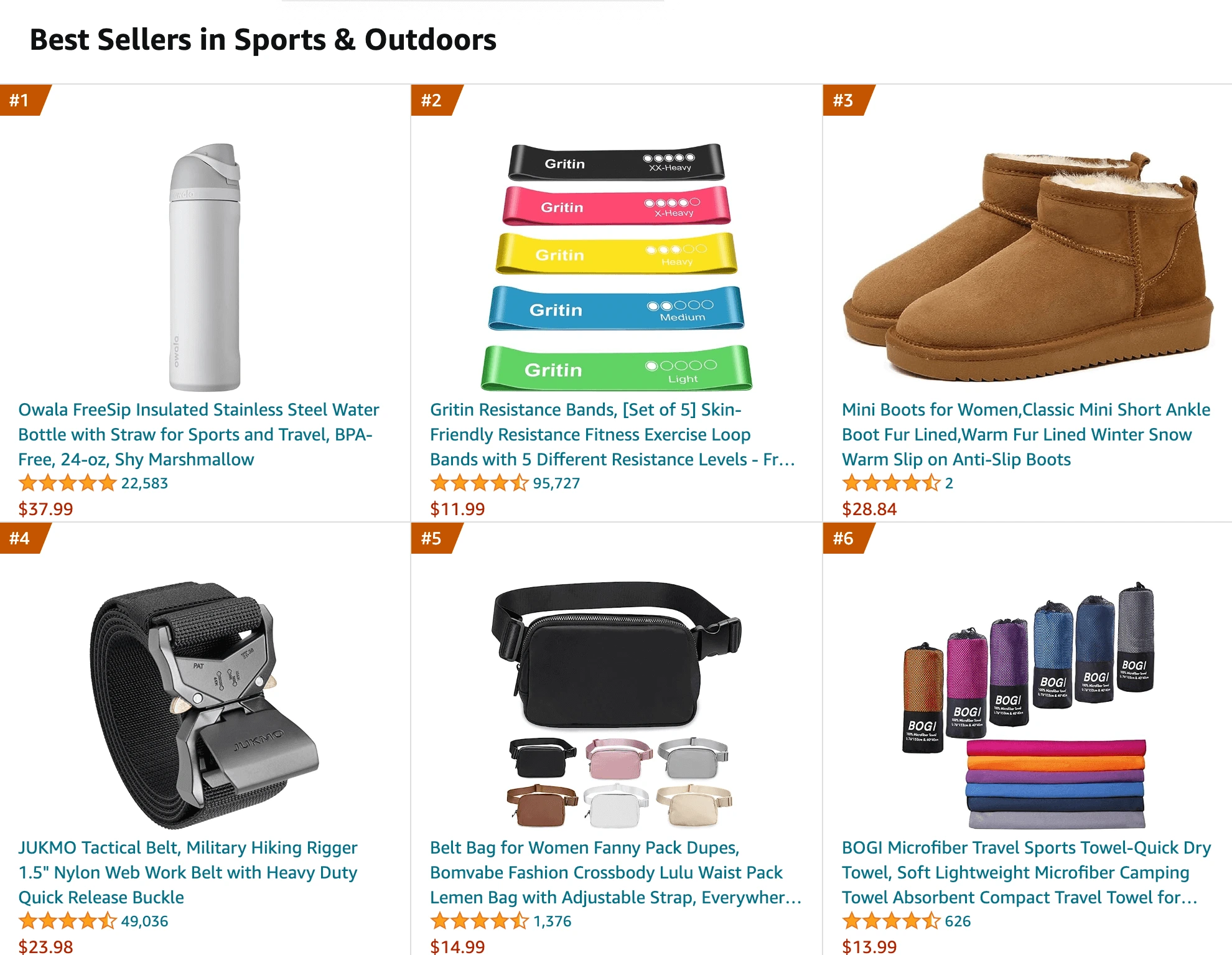

Amazon.ca is very similar to amazon.com operationally and both platforms have a very similar customer base. In terms of well performing products there is no hard and fast rule, just like in the US marketplace. There are wide variety if products that perform well within each category. Here are some best sellers in the home category.

Now these are just the top 6 best sellers in the home category, but that does not mean that other products within the home category do not perform well. Sometimes taking a look at the best sellers can help you find a product with good potential so this is definitely a good place to start, but there are so many other ways to conduct product research.

Here is another example of some best sellers in the sports category.

Once again, this just means that these brands in particular have made a lot of sales. Owala might have made the most sales in bottles, but their is enough room in the market for other water bottle sellers too.

If you are looking for product research strategies to find winning products then look no further! Sign up for our product research guide here.

That being said, if you are currently selling on another amazon marketplace and expanding to sell on amazon Canada then you can use your existing products to sell here. To see how well they can potentially perform in the Canadian market you can use the technique I previously mentioned for estimating potential sales revenue.

How Do I Launch a Product on Amazon.ca?

In order to launch successfully, we are going to need to re-optimize your listing. We need to conduct keyword research again and put together a list of trending and highly searched keywords in the Canadian marketplace. To learn more about how to conduct keyword research, read this blog.

Once we have our list of keywords we will move onto listing optimization. The good news is that having sold in another marketplace we already have our images and our listing copy. All we would need to do is re-write our product title, and restructure our listing copy to include the list of keywords we put together. The product images can stay the same, we may need minor tweaks made to the information and to spellings. Now that our listing is up to date we can move onto PPC.

We can do a PPC launch, setting up campaigns in a similar manner as we would on any other marketplace. The keywords we want to target should be highly relevant and the bids should be on the higher end on the Amazon suggested range.

How Do I Add My Existing Amazon.com Listings to Amazon.ca?

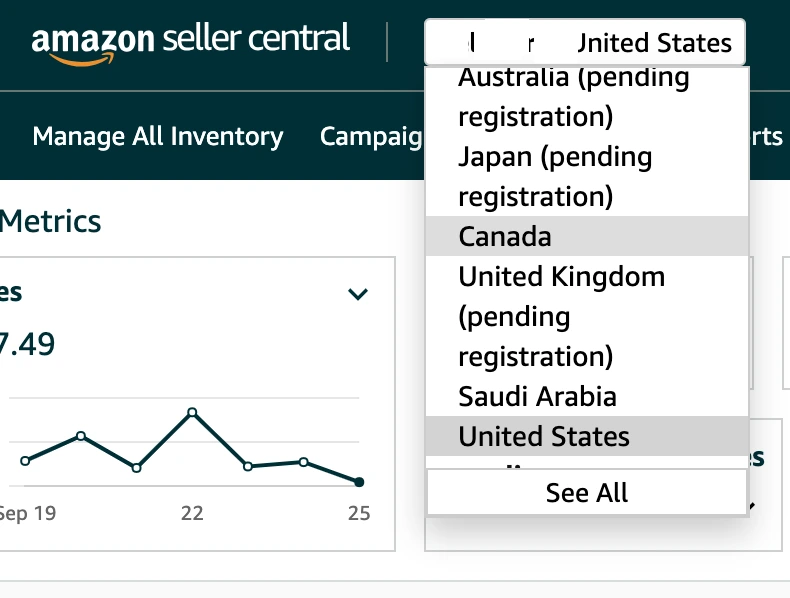

Previously, sellers were required to maintain separate seller accounts to operate in the U.S., Canada, and Mexico. However, Amazon now offers what they call the North American Unified Account, streamlining the process for sellers. This unified account enables sellers to easily toggle between the seller tools for Amazon.com, Amazon.com.mx, and Amazon.ca within Seller Central, allowing them to manage all marketplaces through a single professional seller account.

When you create an account in any of these marketplaces, you are automatically granted access to this unified account. To switch between the marketplaces, simply navigate to your seller name at the top of Seller Central and select Mexico, Canada, or the U.S. from the dropdown menu for seamless management. To upload your existing listing from amazon.com to amazon.ca, go on Canada from the drop down menu.

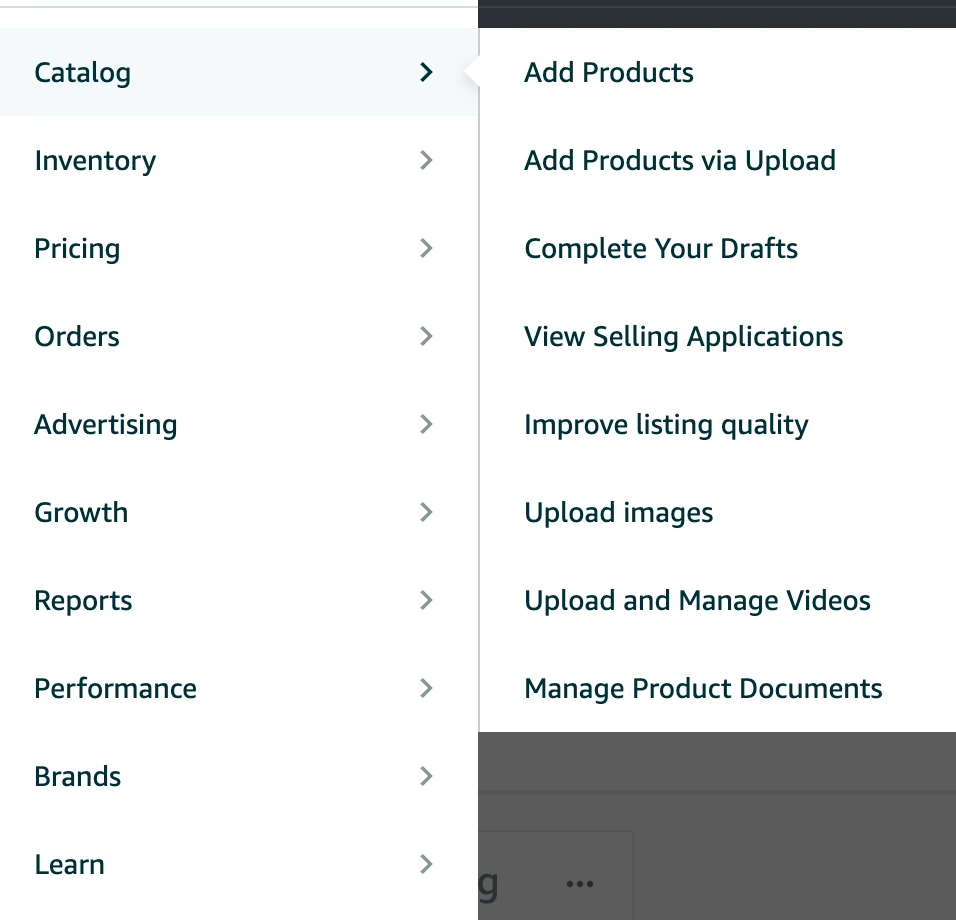

Then click on the top left hand side menu bar, to see the option of catalog. Hover over ‘Catalog’ in order to be able to click on ‘add products’. This will take you to another page.

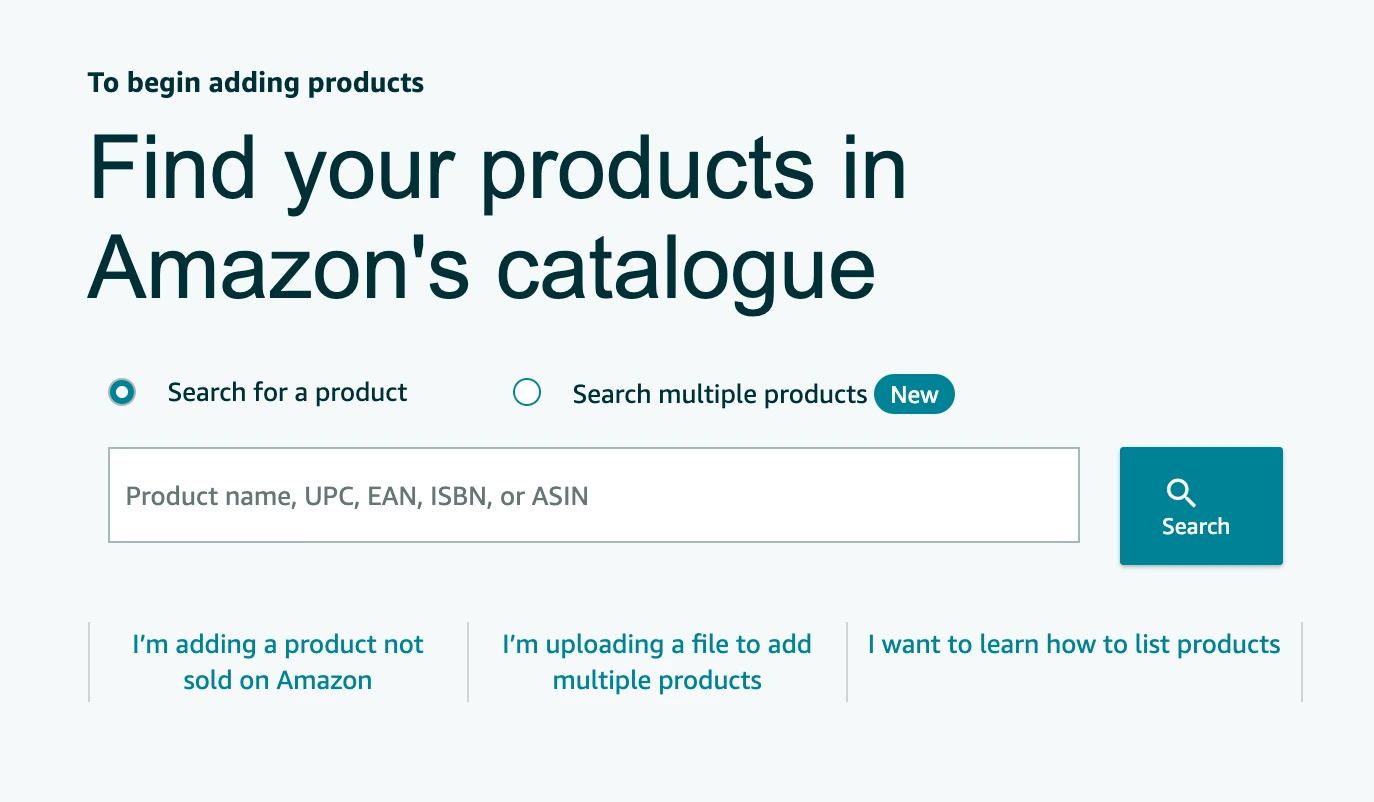

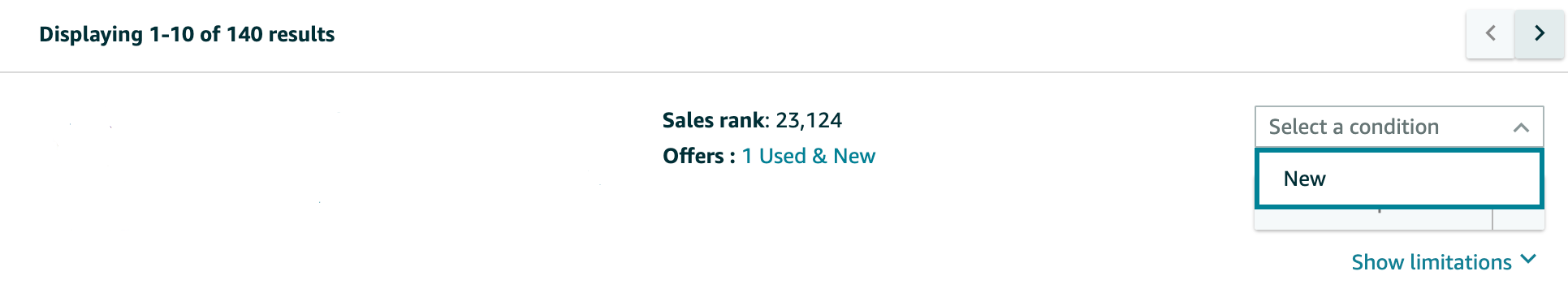

Here, you can search for your product through the ASIN, UPC, or even brand name. Hit search and all the products will be displayed at the bottom.

Once you see the product that you want to move to amazon.ca, go onto the select a condition field and hit ‘new’.

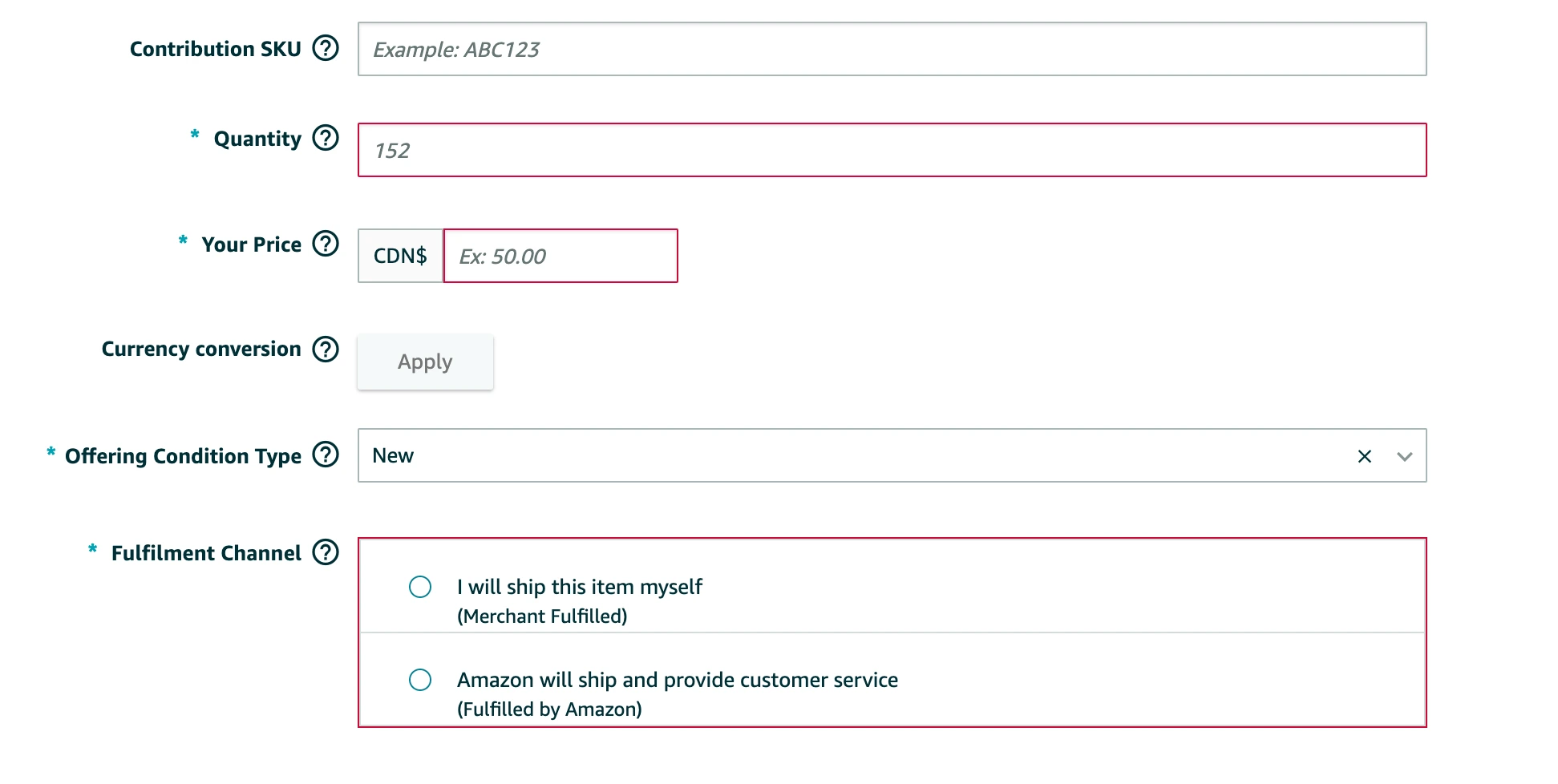

Then hit ‘sell this product’. This will take you to yet another page.

On this page you will be asked a bunch of basic questions, you can answer these according to your preferences. The most important section though is the SKU field. It is absolutely crucial that you enter the SKU correctly because this will help amazon identify that this is the same product as the one you’re selling on the US market, and will merge your reviews. Once you fill this out you can save and finish. Boom you’re done!

Tips for Selling on Amazon Canada

Account For Higher FBA Fees

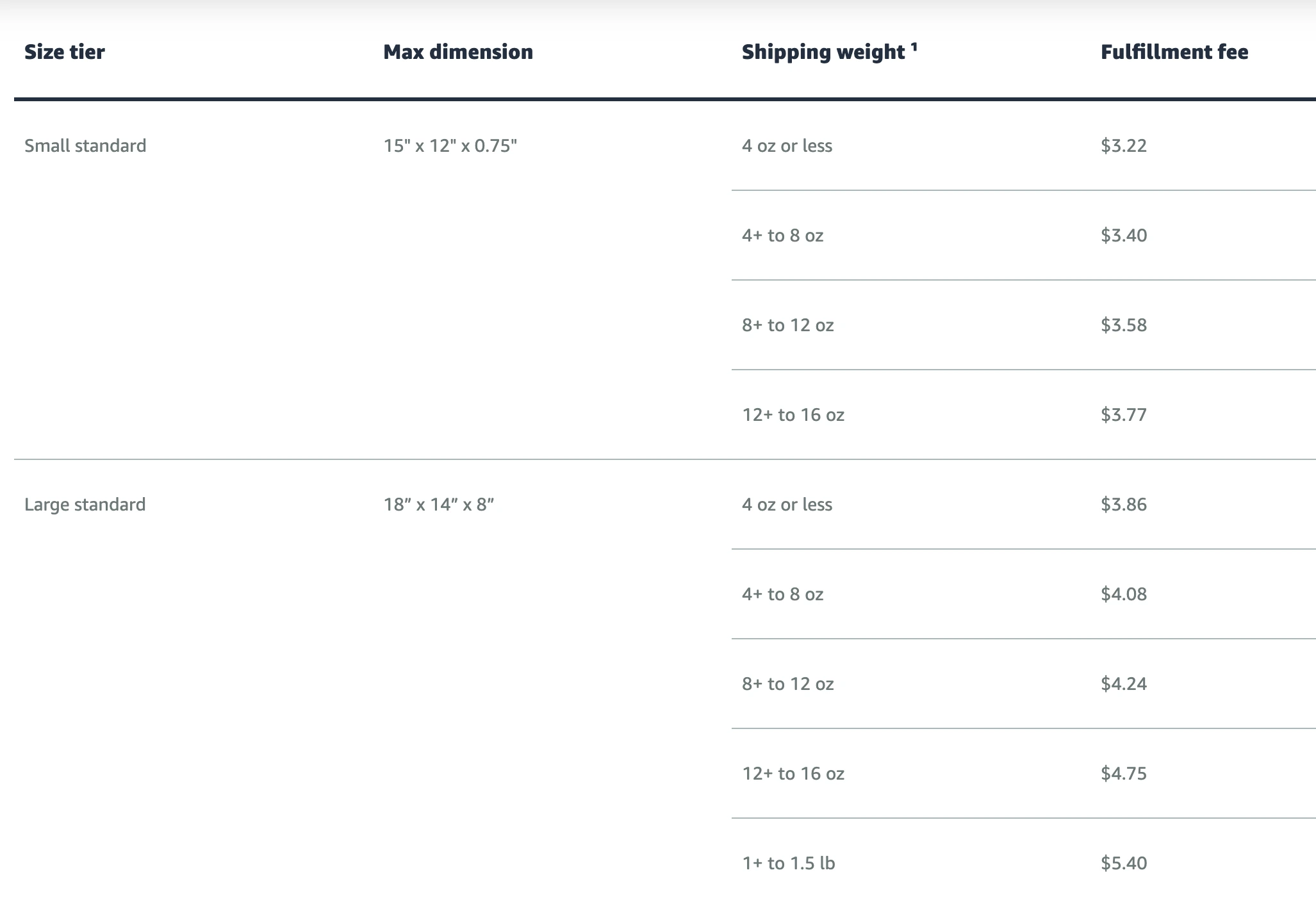

Amazon Canada selling fees can vary from its US counterpart. FBA fees in a Canadian seller account are generally higher. To demonstrate a comparison of the two, these are the US charges.

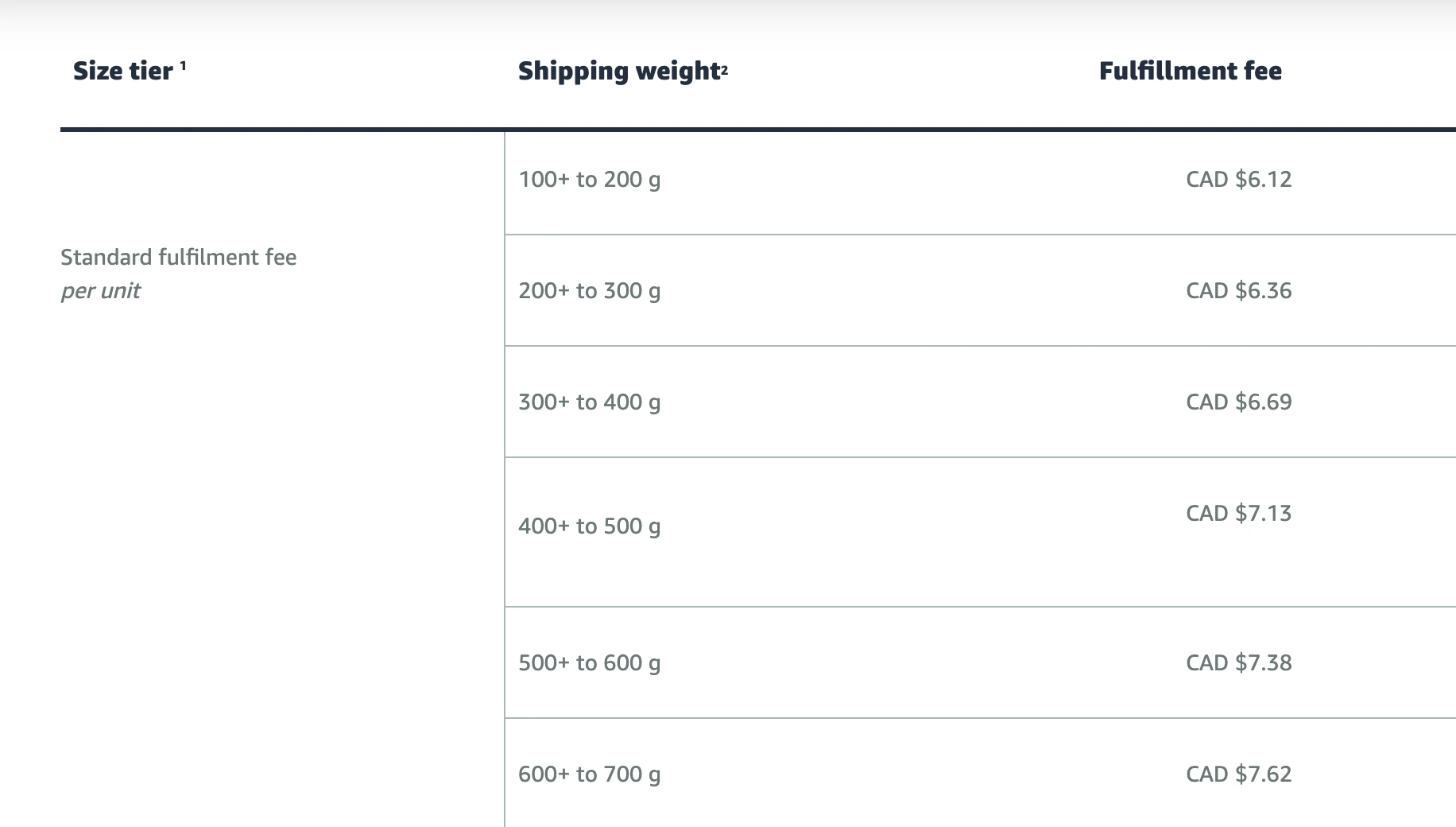

Let’s take the smallest package as an example. For a package of 4 ounces or less, the fulfillment fee is $3.22. Now let’s take a look at the Canadian fees.

For a 100g (3.5 ounces roughly) package, Amazon FBA charges $6.12 Canadian dollars, which comes out to $4.55 USD (calculated at the time of writing). This is $1.33 more expensive, and it is calculated on each shipment so the cost could really add up.

This information is key to consider when coming up with your pricing strategy. You may set your price by directly converting your US price to Canadian dollars, but after competitor analysis if you have room for increasing your prices, you may want to consider adding the FBA fee increase to your price. This way you can expand into the Canadian marketplace without taking a hit to your profit margins.

Manage Everything With Next-Level Software

Sign up now to access powerful, easy-to-use tools to help with every part of selling on Amazon and Walmart.

Understand the Tax Rules

International Amazon sellers who are not required or do not want to register for GST/HST will have their sales tax calculation, collection, and remittance handled by Amazon. This seems like the easier option, however, without your GST/HST number you will not be able to scale your Amazon business since there is a sales cap on how much you can earn in sales without being registered. Additionally, the absence of a GST/HST number means you’re overlooking potential tax advantages. If you are registered, you have the opportunity to reclaim any import duties or fees you’ve paid. This implies that as a business, you can deduct your incurred import expenses from your GST/HST amount, ultimately reducing the overall tax obligation you’ll be responsible for.

On the other hand, non-resident sellers who exceed $30,000 in Canadian dollars over a 12-month period may need to register for, collect, and remit sales taxes themselves. Any import duties or fees you pay can be reclaimed if you are registered. Meaning these import costs that you incur as a business can be deducted from your GST/HST amount.

To scale your Amazon business you will need to be GST/HST registered, and in order to be registered you will need a business number. You can do it yourself by looking up the RC1 form on the government of Canada’s website here. Once you submit this form, you will get a GST/HST number within a month or two. To ensure accurate sales tax filings and compliance with these tax requirements, seeking assistance from tax professionals is crucial.

Monitor the Exchange Rate

As a general rule, the more you engage in currency exchange transactions, the greater the likelihood of losing value in your currency. The reason being that your payments are time sensitive, so it is very hard to not incur a loss in exchanging currencies constantly.

An important factor to consider is the location of your bank account. Having a bank account in another country when all your expenses will be in Canadian dollars might mean you’re getting the worst end of the stick. When getting charged for transactions, amazon.ca will be converting your currency to the Canadian dollar. Then when it’s time to get paid, amazon will send you payments in Canadian dollars. If your bank is located in the US then it will convert your payments to US dollars, for example. This means the payments will be converted twice, whether making them or receiving them, and you’re at the mercy of Amazon’s exchange rate.

In order to save money and avoid losing money to currency conversions, it is best to have a Canadian bank account so that you can keep the payments you receive in Canadian dollars. Then when it’s time to make a payment for a transaction, you can make it out of the same account. This will help preserve the value of your earnings.

Consider Using Remote Fulfillment

With Remote Fulfillment through FBA, you can sell to customers in Canada and Mexico without the need to ship inventory to these countries. When you join the program and list your products on Amazon.ca and Amazon.com.mx, Fulfillment by Amazon leverages your inventory stored in US fulfillment centers to fulfill customer orders across the border. There are some remarkable benefits to this model.

Prime customers enjoy complimentary shipping to both Mexico and Canada, with Amazon taking care of export logistics, addressing customer inquiries, processing refunds, and handling returns for your orders.

Secondly, when customers purchase products using Remote Fulfillment with FBA, the buyer assumes the role of the importer of record and is responsible for covering any import duties, taxes, and fees that may apply.

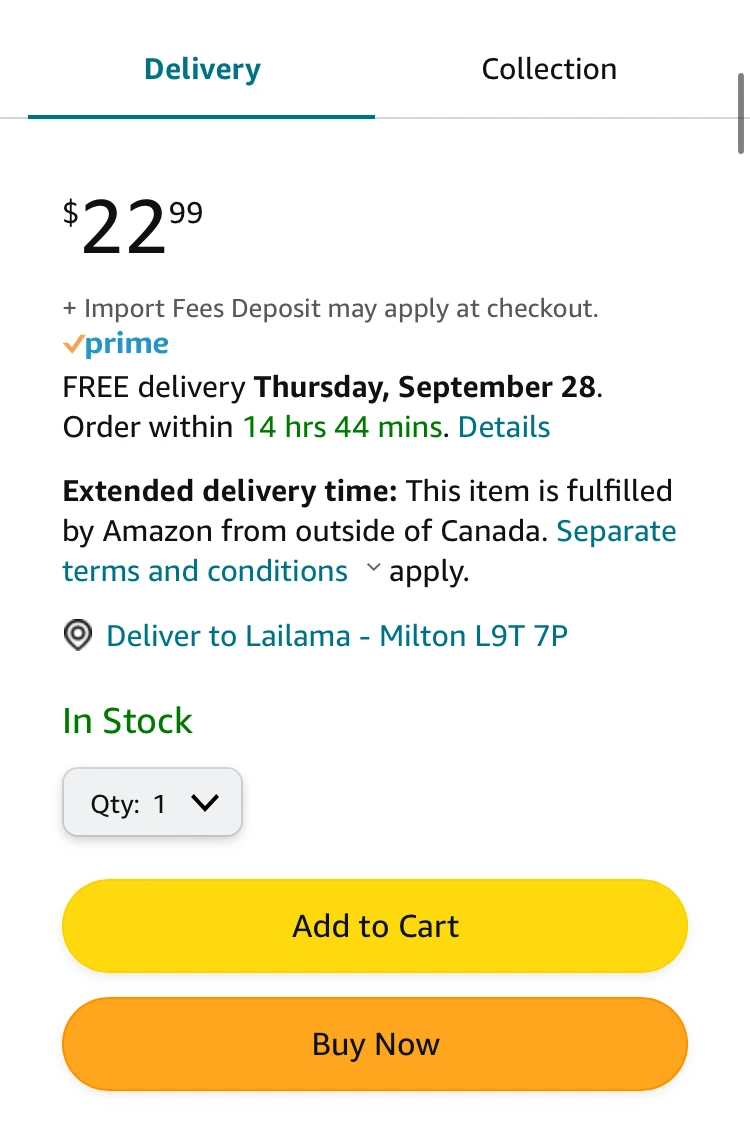

Amazon handles the import duties, by approximating the import fees deposit, and incorporating them into the customer’s checkout total.

And lastly, the Build International Listings tool replicates your existing US offers and computes international prices by factoring in your US prices and any fee variations. You have the ability to tweak your pricing if needed.

However, there are some drawbacks to the model as well. The first one being that although your customers can avail Prime shipping, delivery is free but its not within the regular two-day window, it takes a lot longer. This may make your buyer go for your competitor who offers two-day shipping.

Another drawback is the passing on of the import fees and duties. A buyer may like your product, but once they land on your product detail page they’ll see text saying ‘import fees deposit may apply at checkout’. That may discourage them from making the purchase.

Enroll in Brand Registry on Amazon.ca

Once you are ready to start selling on amazon Canada, it is time to crush it. To capitalize on this opportunity, it is pivotal to have a professional account to make use of Amazon’s advanced selling tools. A lot of the unique marketing and branding features can be unlocked by enrolling in brand registry. In order to get an in-depth guide on brand registry, read this.

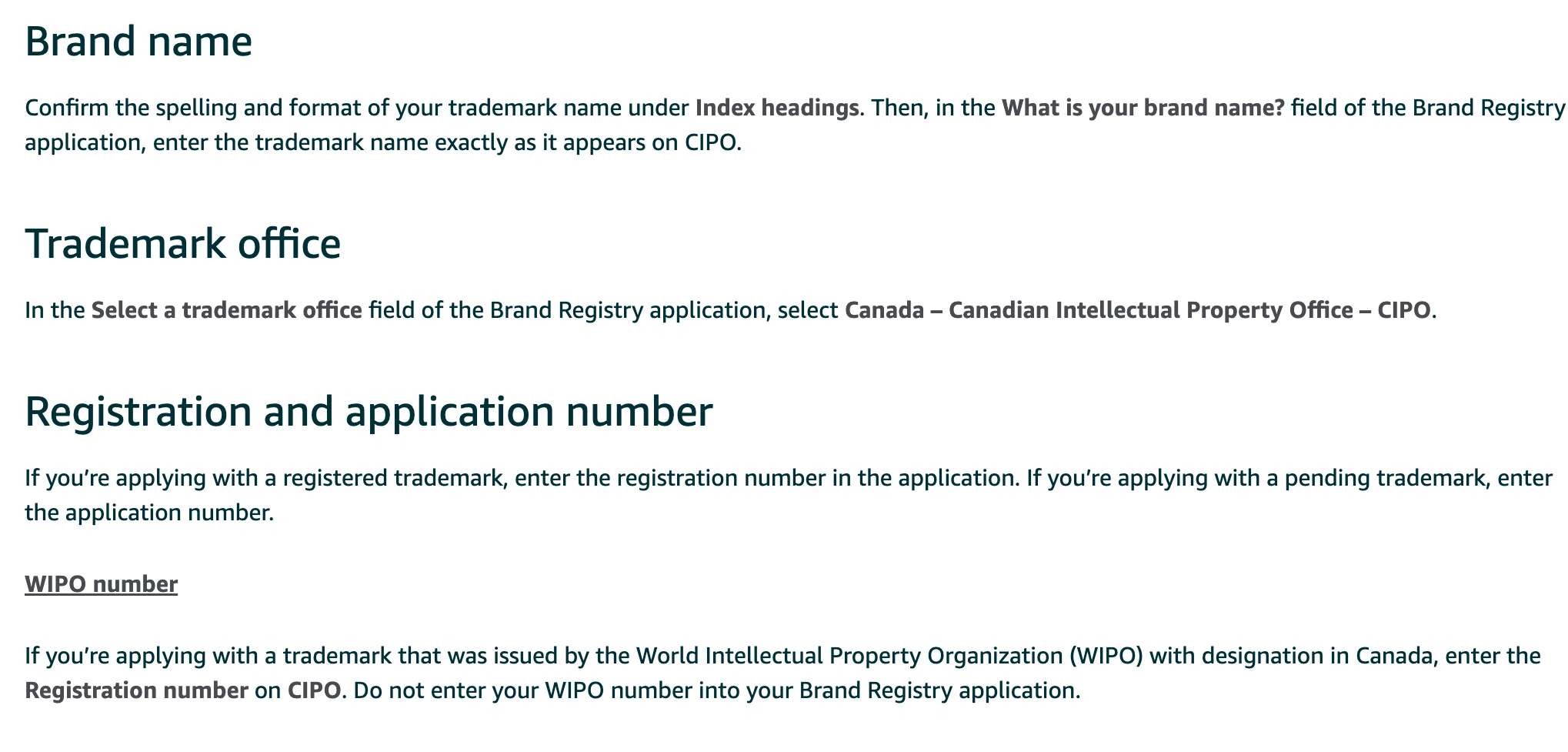

To complete the Brand Registry application, you must look into to the country specific guidelines. To begin, visit the Canadian Intellectual Property Office (CIPO) and initiate your trademark search by adhering to the instructions provided below:

1. Enter your trademark number, keywords, or any other distinctive information into the search field, and then click the “Search” button.

2. Locate and select your trademark from the search results table.

Refer to the table below to determine whether your trademark falls under the “Registered” or “Pending” category in the Brand Registry. When completing the application, choose the relevant status. For instance, if your CIPO status says formalized, when completing the application’s “What is the current status of your trademark?” field, you will choose “Pending” as your status.

Conclusion

Selling on Amazon Canada presents a compelling opportunity for both new and experienced Amazon sellers. With its vast customer base, robust infrastructure, and streamlined fulfillment options through Fulfillment by Amazon (FBA), the platform offers a convenient way to reach Canadian shoppers and expand your Amazon business globally.

Achieve More Results in Less Time

Accelerate the Growth of Your Business, Brand or Agency

Maximize your results and drive success faster with Helium 10’s full suite of Amazon and Walmart solutions.